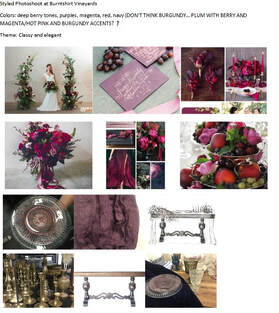

Mood Board for Styled Shoot created by florist Hailey McGhee of Roseraie Floral Design

Mood Board for Styled Shoot created by florist Hailey McGhee of Roseraie Floral Design

Mood Board for Styled Shoot created by florist Hailey McGhee of Roseraie Floral Design Mood Board for Styled Shoot created by florist Hailey McGhee of Roseraie Floral Design Mood Boards are a popular new way for brides (or event planners) to communicate their ideas for themes, colors, and style to their vendors. But they are not really a new thing. Years ago, brides cut and pasted ideas for their wedding into noteooks. Many people use "vision boards" to express their thoughts about their future - goals, missions, or resolutions. More recently, Pinterest became a popular way for people to "cut and paste" photos from the Internet to an online bulletin board that highlighted their favorite ideas. But sometimes those boards got crowded with ideas that later became irrelevant as the person narrowed their thoughts. And sometimes Pinterest boards can be difficult to share. Mood Boards can be physical, or virtual. They distill your ideas into one, simple, board - a collage of 5-6 photos showing the key themes, styles, and colors you desire for your event. Pinterest Boards can still be used to manage your Mood Board, or you can use a photo editing program or app (I like Adobe Photo Shop or Pic Collage), to combine photos into a one-page *pdf document you can email to your vendors. (You can also do this in Word.) Mood Board can also be a great way for florists, stylists, and event planners to express their understanding of what their clients want. Below are some example of mood boards for a backyard wedding: A Wedding Loan Option

Unsecured loans, also called personal loans or signature loans, involve borrowing money without putting up any collateral. LendingTree personal loan offers allow you to shop for the best rates and terms for personal loans up to $35,000. What Are Wedding Loans? The cost of the average 2016 wedding was $35,329, according to the XO Group. It’s the highest recorded average, and a heavy price to pay to walk down the aisle. It’s one that most people can’t float even with savings. To finance these costs, many couples turn to wedding loans. Wedding loans aren’t something your financial institution will have on their register of products. Rather, they will issue you a personal loan you can use to finance wedding expenses. When you get a personal loan, you will receive all your money upfront. You can get an unsecured personal loan for your wedding — which means you won’t have to put up any collateral — but you will have to make monthly payments throughout a set term. Personal loans come with either fixed or variable interest rates. Fixed rates tend to look higher when you’re comparing loan options, but because they stay stable throughout the course of your loan term, your loan payments and costs are predictable. Variable rates change with the market, so you may see increased rates after you start paying, making monthly payments less predictable. With good credit and a favorable debt-to-income ratio, you may be able to get a personal loan with an interest rate much lower than a credit card APR, but rates vary widely by lender, loan term, loan amount and application qualifications. Why get a wedding loan? Wedding loans can help you avoid potentially undesirable situations like dipping into your savings or using credit cards with high interest rates to cover the costs of the celebration. It can also allow you to avoid asking family for money, but if you’re comfortable with that and can get a 0 percent interest loan from a family member, that may be a good route to take. It would allow you to spread out the costs of the event without incurring interest charges or loan origination fees. However, you may not have family members who are able to loan such a large sum, or you may be wary of the strain such a large loan would place on your relationship. Borrowing money for a wedding could also help you preserve your savings. A solid emergency fund is an important financial tool to have at your disposal, and you may want to keep that money where it is should a catastrophe pop up. Keep in mind that if your savings is allocated to something like a home purchase, though, taking out a large personal loan may affect how much money you can borrow for a mortgage, or even put your approval in jeopardy. Wedding loans may help you afford the day of your dreams, but be careful: You want to be sure you can afford any loan you take out. The risks of financing your wedding Financing your wedding may be able to help you afford more in the moment, but it can lead to financial stress down the line. Not only will you have to repay the money you borrowed to afford a great venue or invite more guests, but you’ll also have to repay interest. Tara Falcone, a certified financial planner and owner of ReisUP LLC, cautions against financing your big day. “If you cannot afford a luxurious wedding upfront, you’re still not going to be able afford it with a credit card or personal loan,” she says. Merging finances with your partner “is tricky, anyways,” she says. “The last thing you should do is put a heavy debt burden on the relationship from the get-go.” Money problems are one of the top three causes for divorce, according to the Institute for Divorce Financial Analysts. (The other two, incompatibility and infidelity). Adding debt to a new marriage could start problems early on. The money you have to allocate toward repaying a wedding loan could make it harder for you to reach other financial goals, like saving up to buy a house, have children or get out of student loan debt. How to get a personal loan If you are interested in getting a personal loan to fund your wedding day, the first thing you’ll want to do is some comparison shopping. You can use this tool to see who is offering the best rates and terms for your specific situation. Here are some of the line items you’ll want to consider:

How to get the best rate Lenders will determine your interest rate based on a number of different factors, including your credit history and income. For a personal loan, having a DTI below 36 percent is considered good, and a good way to improve it is by paying off your debt. (When looking at your credit history, one of the determining factors will be your debt-to-income (DTI) ratio. A debt-to-income ratio is calculated by dividing total recurring monthly debt by gross monthly income. For example, if your monthly debts equal $1,000 and your gross monthly income is $4,000, your DTI ratio is $1,000 / $4,000 = 0.25 or 25 percent. Lenders prefer for borrowers to have a debt-to-income ratio of less than 36 percent, with no more than 28 percent of that debt being paid toward the mortgage. Generally, it’s difficult for a borrower with a DTI ratio greater than 43 percent to be qualified for a loan.) Paying off revolving debt (e.g. credit cards) will also help you improve your credit utilization rate. This number looks at how much credit you have extended to you, versus how much you are actually using. Using a small amount of your available credit can have a positive effect on your credit score, which can help you qualify for lower interest rates when you are borrowing money. You could also work to improve your DTI and credit utilization by increasing your income and, as a result, pay more toward your debt. Go for that promotion at work. Bring up salary at your annual performance review. Start a side hustle. The more documentable income you bring in, the better. Plus, you can use that extra cash to save for your wedding so you won’t feel like you have to finance it. Other ways to finance a wedding If a personal loan doesn’t sound like the right solution for you, there are other options. Falcone, the financial planner, used a credit card with a 12-month, 0-percent APR promo to pay some of her wedding expenses upfront. “We could technically afford our wedding, but we didn’t want to dip into savings,” she says. “We used it for large, upfront expenses. The caterer, for example. We made sure to pay it off in full, chunk by chunk, over the course of six months. We could do that at 0-percent interest with no financing costs.” Because she paid off her balance in full before the promotional rate expired, she was able to maintain her savings and dodge paying any interest on her wedding expenses. If you have good credit, you may be able to qualify for a credit card with such a financing promotion — with some offers available now, you could get nearly two years of interest-free financing on new purchases. Another option is a home equity line of credit (HELOC), if you’re a homeowner and have equity in your home. When you have a HELOC, you can tap it for specific amounts of money when you need it. How to use a wedding loan responsibly If you choose to pursue a personal loan, you’ll need to know how much money you need up front. It’s important to not borrow more than you need. If you do, you’ll end up paying unnecessary interest. On top of not borrowing more than you need to pay your wedding bills, you also want to make sure you keep your wedding budget in a range where you’ll be able to reasonably pay off your debt. Missing loan payments can significantly damage your credit standing, which could hurt your ability to rent a home, get a mortgage or, in some cases, get a job. To avoid these pitfalls, sit down with your partner and figure out how much you can reasonably afford to pay each month. Then, weigh your budget against the personal loan quotes you receive. If your wedding expenses will result in a monthly bill that will exceed your budget, you must lower your wedding expenses. How to avoid financing a wedding with loans or credit Falcone passionately warns against the dangers of financing a wedding you can’t currently afford. She also has some tips for keeping your costs down so you won’t have to apply for credit in the first place. First, for her wedding, she kept her guest list as small as possible. The same XO Group study that found the record-setting average wedding expenditures also found that cost per guest had gone up over previous years. Consequently, one of the most effective ways to cut your wedding costs is to limit your guest list. Falcone also looked at the resale market. For example, she wanted a very specific — and very expensive — wedding dress for her big day. She researched what she might be able to sell it for after she and her husband had exchanged vows. “I knew I’d be able to sell it for roughly half of what I paid for it,” she says. “I essentially split the cost with another bride.” Finally, she negotiated and stuck firmly to her budget with each vendor. “Whenever a company or a provider hears the term ‘wedding,’ for whatever reason, instantly the prices jack up,” she says. “If you have a set budget in mind for food, venue, music, a photographer or flowers, make sure you go into the meetings with that number, and don’t budge. A lot of times they’ll be willing to work with you rather than lose your business.” Falcone also notes that while the decision will have to be weighed for each individual couple, waiting to get married in order to save for a more lavish event is another option. If you must have a big, expensive wedding, she recommends this over going into debt. For the full article and additional financial advice, visit www.lendingtree.com/personal/wedding/#what-are-wedding-loans So many brides today are opting to DIY (Do-It-Yourself) at least part of their wedding -- whether it's flowers, decorations, favors, or accessories. And there are so many great ideas out there! Check any wedding magazine, website, blog, or Pinterest. It all looks soooo easy! And I’m all for it. It lends a true, personal touch to your event, and it can be a fun project for you and your fiancé or friends to bond over. Might even save a little money. But as the person who usually ends up setting up these DIY creations, let me share a few words of advice.

Keep it Minimal Every bride starts off saying, “We're going to keep it simple.” Nine months later, they’ve got 20 things to set up on each and every table. Consider that it takes 3 to 5 minutes to set each element. So for table runner, centerpiece, and candles, that's 12 to 15 minutes per table. If you've got 20 tables, that's going to take a while. Once you’ve found a great idea, check the wedding boards on The Knot or search wedding blogs to see if someone else has done it and read their advice. Send a message to that Pinterest user to get more information. Email the product seller and get specifics about equipment required and set up instructions. Just remember, that the more you add, the more help will be required. Keep it Light Heavy accessories like glass jars, wood discs, stones, and corn hole games are hard to transport, set up, and pack up. Consider how you're going to move these things in and out. They also require more time to set up. Make sure the venue has hand carts, and that they will allow you extra time to load in and out. If they will let you bring the heavy stuff ahead of time, even better. And if you are depending on someone who is in the wedding to do this, they are going to need time to go home and shower after. It’s hard to look you best after moving 150 bricks! Hiring some extra labor works best. Keep It Low If you plan to make and hang banners, garlands, lanterns, or lights, be warned that these are major installations that take a lot of extra time. First, check with your venue before ordering. I can't tell you how many times brides have come with bunches of hanging items only to find that staple guns or nails are not allowed. Or there are no ladders, scissors, or hammers to be found. Perhaps the desired effect could be accomplished with something easier -- just one cluster of lanterns hung from a center chandelier, or canned lights that are easily plugged into a wall to project light or color onto the ceiling. This is one area where a rental or décor company might be the best – and safest option. Hungover groomsmen on ladders=bad idea. DIY Flowers You went to the florist and returned with a bit of sticker shock. So you decided to do the flowers yourself. After all, there are fresh flowers available in the grocery store, the farmer’s market, even online. How hard could it be? Well, it’s not hard, if you have time. And space to work. And tools to work with. It’s not as simple as just plopping some flowers in a mason jar. The flowers need to be sorted, cut, and arranged in a pleasing way. I’ve found that it takes 15-20 minutes to do one arrangement. Bouquets and boutonnieres take even longer. Flowers are perishable, so you can’t do them too far ahead. And sometimes the beautiful pink roses you saw at Sam’s in January just aren’t there in July. (BTW, the quality of grocery store flowers is also undependable.) Then there’s the cleanup. Who is going to remove all the water, vases, and flowers at the end of the night? That being said, it can be fun to have a flower arranging party with your girls the day before the wedding. Western North Carolina is blessed with some great cut-your-own flower farms. But if Aunt Betsy has planned a bridal shower for Friday, you may not have time to do both. You definitely won’t have time day of. Does it really save money? Well, to be honest with you, by the time you order all the supplies (at full retail price), DIY flower projects can be costly. So be sure you are taking this on because you love, love, love the idea, and not just to save money. And consider using a florist for at least part of the décor, and DIY the rest. Most are happy to compromise. Free Favors or Favor Free? The whole favor thing is sometimes blown out of proportion. Remember, a favor is simply a small token of thanks to the guest for coming to your wedding. It does not have to be big, or practical, or useful. It's no thanks to require your guest to carry some heavy jar, plant, or, God forbid, fish, home with them. If you must create this type or favor, don’t make one for every guest. Wedding guests are favored out – many just won’t take them. It’s better to make simple favors, like a fabric square filled with candy, or a chocolate bar with a personalized wrapper. The time and money spent to create and set up 100 favors might be better spent on décor. Just be sure to thank your guests in person at the event, and in your thank you notes. The Y in DIY Remember that on the day of the wedding you will be busy getting ready, getting your hair done, getting dressed, getting photos, and, hopefully, getting to hang out with your friends and family. You cannot be the You in Do-it-Yourself on the big day. Relying on family or friends to do it is not fair to them, either. You'll need a day of coordinator or a team of hired hands to do it for you. One Last Piece of Advice My friend Beth Stickle, florist and owner of Bloomin’ Art, tells a funny story about DIY from her own wedding. She and her fiancé decided to save some money on rental costs by picking up and setting up the ceremony chairs themselves. Because they would not have time to do this the day of the wedding, they asked their friends to stay after the rehearsal to help. So they set up the folding chairs in a lovely spot by a lake and took off. Next morning they returned to find a flock of geese had enjoyed the new “roosts” overnight. And the friends? Too hung over to make it to the early morning set up session. “So instead of spending my morning decorating for my wedding and getting dressed, I spent it cleaning goose sh** off 200 chairs. Not pretty.” Something to think about! |

AuthorMiss Ellie is the perfectly proper wedding planner to whom we all turn for wedding planning advice. To ask a question, just click the email button at the top of the page, or leave a comment and she will respond. Archives

November 2020

|

RSS Feed

RSS Feed